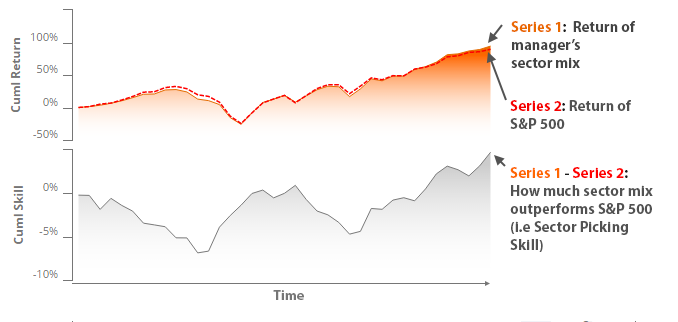

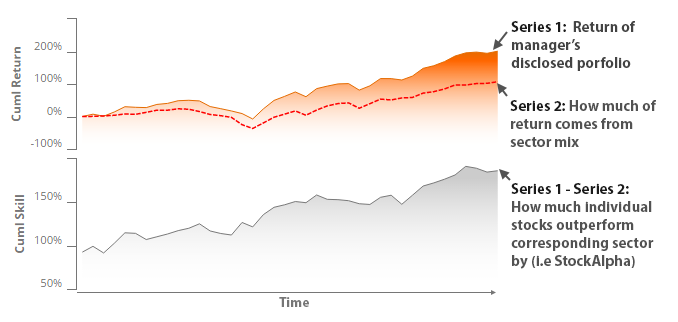

StockAlpha

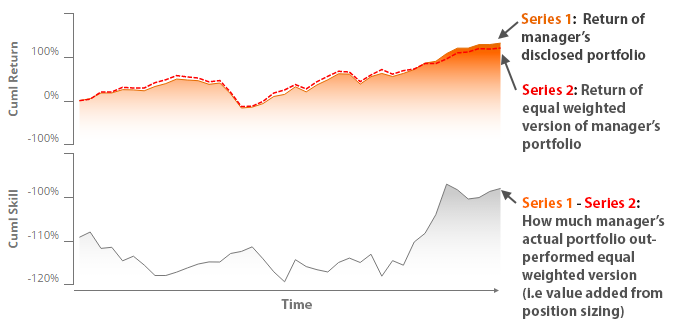

A fund’s StockAlpha score isolates the alpha a manager generates by picking the right stocks. A skilled manager should demonstrate consistently high StockAlpha.

To calculate a manager's StockAlpha score, we calculate the cumulative return of a manager's disclosed portfolio. We then map each security to a sector, and estimate how much of the return is attributable solely to the sector mix. The difference between the return of this portfolio and manager's actual portfolio tells us to what extent the manager's individual stock picks outperformed their corresponding sector