Background

Symmetric provides the public reference-point for hedge fund investment skill. Some of the most sophisticated hedge fund allocators (hedge fund of funds, family offices, endowments) and financial advisors incorporate the analysis and rankings for due diligence and on-going monitoring of their hedge fund investments.

Many equity managers market themselves on their ability to pick individual stocks and are paid 2 and 20 for this skill, but it is often difficult to look at a hedge fund's overall returns and know how much of that came from stock picking.

Symmetric begins with a historical database of hedge fund holdings across a universe of more than one thousand funds. By observing how these holdings change and perform over time, we can assess the underlying skill of the investor and attribute it to their ability to pick stocks or sectors and size positions.

Symmetric's rankings are unique in the industry because they are based on isolating manager skill as opposed to returns. Overall hedge fund returns are driven by a number of factors including stock picking, sector picking, net long/short exposure, leverage, etc. All these factors drive returns, but managers are typically paid high fees of two-and-twenty for their stock picking skill or StockAlpha.

Symmetric's rankings are the first in the industry to isolate stock picking alpha and publicly rank hedge funds based upon that metric. The platform's analysis provides a framework to force-rank each hedge fund manager. The rankings illustrate the relative skill of equity long-short managers express, the most important of which is picking stocks.

The Quarterly Symmetric Stock Pickers Rankings recognizes those managers that are exceptional stock-pickers overall and by sector and the key investments themes that drive the industry. More importantly, it introduces the transparency with which ordinary investors can see the best possible publicly driven analysis of hedge fund decision-making and performance.

Methodology

Data

Symmetric begins with a historical database of hedge fund holdings across a universe of more than one thousand funds harvested from regulatory filings. Because hedge funds are required to file with the SEC, using regulatory filings to calculate rankings controls more effectively for survivorship bias compared to hedge fund analysis that depends upon self-reporting. By observing how these holdings change and perform over time, we can assess the underlying skill of the hedge fund and attribute it to their ability to pick individual stocks.

Measuring StockAlpha

StockAlpha measures a hedge fund manager's ability to pick stocks that outperform their corresponding sector. The commonly used Brinson-Fachler performance attribution methodology provides the foundation for the Symmetric approach. Intuitively, our approach is equivalent to calculating the performance of a portfolio in which each individual stock position is hedged with a sector index to create a market neutral and beta neutral portfolio. The return of that hedged portfolio corresponds to the manager's stock picking skill and is what we call StockAlpha.

The rough intuition behind how this is calculated is as follows: let us assume that a hedge fund manager held Apple stock for a quarter. If Apple rallied 10% over that quarter at the same time as when the technology sector rallied 7%, much of that 10% return may have been coming from the sector. The manager in this instance picked a great sector, which is worth ~7%, but the manager's ability to pick stocks that outperform its peers is ~3% (10% minus 7%). We define StockAlpha as one's ability to pick a security that outperforms its sector.

To calculate StockAlpha, a managers' long positions are first harvested from 13-F filings on a quarterly basis. The quarter-end sample forms the basis of a return-series that assumes the manager is able to trade in and out of the new and old positions at security prices at the end of each quarter. We calculate the return of the publicly disclosed portfolio and the resulting return series is called the "actual return of the publicly disclosed portfolio."

Next, we map each security in the publicly disclosed portfolio to a sector according to a standard industry mapping. We calculate the beta of each stock to its corresponding sector using daily price data with a one-year look-back. The betas adjust the exposure to each sector index required to hedge the individual stock. Based upon this mapping, we calculate the return of a "proxy portfolio" that captures how much of the "actual portfolios" returns come from the sectors that those stocks happened to be in.

The difference between the actual return of the publicly disclosed portfolio and the proxy portfolio each quarter is the StockAlpha of the manager for the quarter. The sum of the trailing four or twelve quarters, respectively, are the StockAlpha for the year or the past three years.

The Symmetric Top Managers - Ranking the Top Skilled Investors

StockAlpha Across the Hedge Fund universe

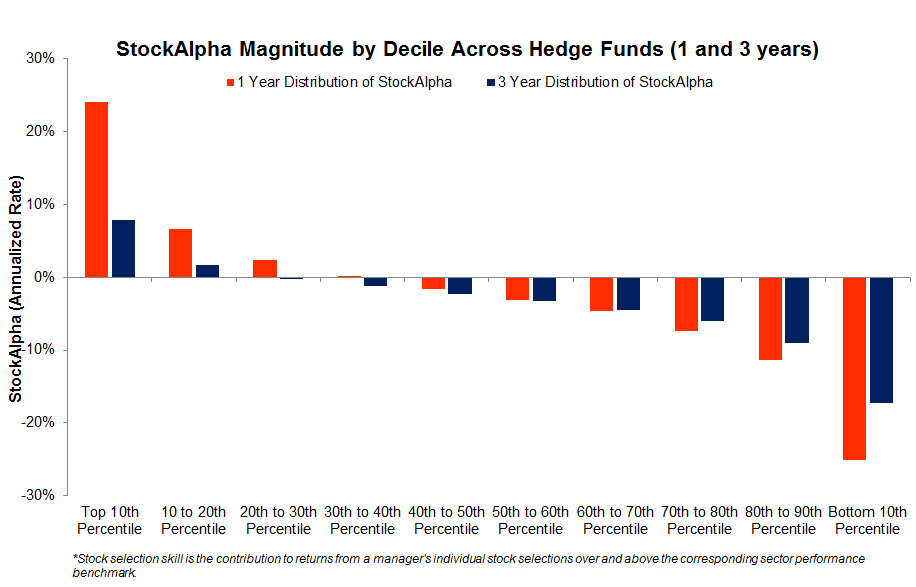

Stock picking is difficult. The distribution of StockAlpha shows that over the past three years just over half of managers have generated positive stock picking skill. StockAlpha has meaningfully declined over the past few quarters, though. Our 3Q - 2015 report indicated 50% of managers had produced positive StockAlpha over the trailing twelve months. This was followed by a decline in 4Q - 2015 to 30% of managers who delivered positive StockAlpha over the previous twelve months. The First and Second Quarter - 2016 reports, however, illustrated a precipitous drop in realized skill over the prior twelve months. The stock-picks of 90% of hedge fund managers had delivered negative StockAlpha and underperformed on a market, beta, and sector adjusted basis in Q1. The Q2 data illustrated an improvement, rising to 20% of managers that outperformed, and the Q3 report showed 30% of managers have demonstrated positive StockAlpha for the trailing twelve months; this means that the number of managers that were able to pick stocks that outperformed their sectors rose to 30%. The Q4 2016 shows 40% of managers have demonstrated positive StockAlpha for the trailing twelve months. Nonetheless, no managers have made the list of top managers consistently for each of the past four quarters.

Symmetric Top Managers Cumulative StockAlpha vs. HF universe Cumulative StockAlpha

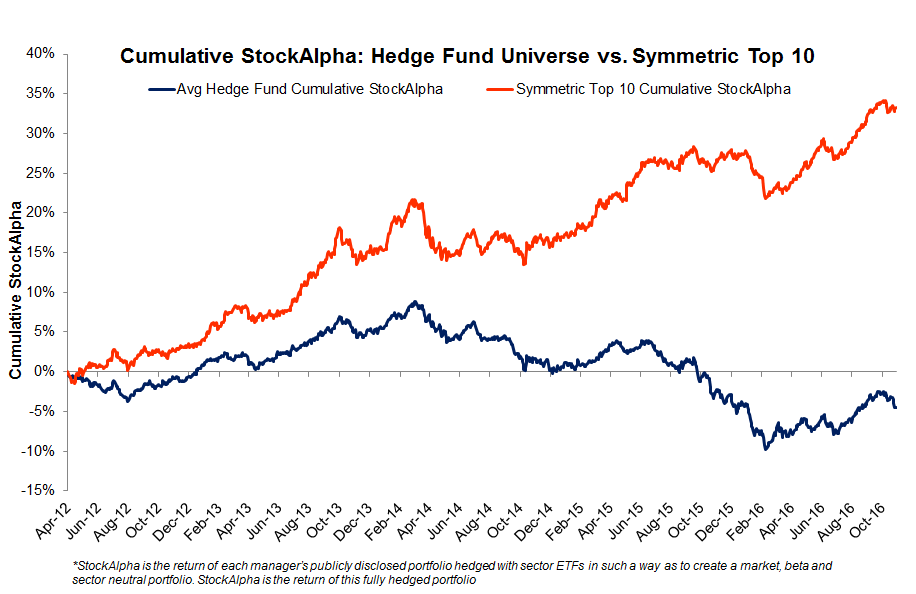

The Symmetric Top Managers comprise the top ranked long-short equity managers. We force-rank the entire Symmetric universe according to their realized StockAlpha year to date, 12 months back and three years back. The list is further adjusted to reflect those whose StockAlpha has not only the greatest magnitude, but also the greatest consistency over each period.

The following chart shows the cumulative StockAlpha for the Symmetric Top Managers vs. cumulative StockAlpha for the entire hedge fund universe. The chart demonstrates the magnitude of dispersion between the best and most consistent stock pickers and the average stock pickers. The Symmetric Top Managers have added over 8.6% of StockAlpha over the past year. The average hedge fund would return negative StockAlpha after fees.

Overall StockAlpha - 4th Quarter 2016 Symmetric Ten

| Name | Founder | 3 Yr StockAlpha Magnitude | 3 Yr StockAlpha Sharpe |

|---|---|---|---|

| JACOBS ASSET MANAGEMENT LLC | Seymour Jacobs | 9% | 1.026 |

| SANDLER O'NEILL ASSET MGMT LLC | Terry Maltese | 7.7% | 0.958 |

| P SCHOENFELD ASSET MANAGEMENT L | Peter Schoenfeld | 4.1% | 0.878 |

| NEWBROOK CAPITAL ADVISORS LP | RobertBoucai | 4.7% | 0.862 |

| DORSAL CAPITAL MGMT LLC | Ryan Frick | 7.1% | 0.755 |

| INTREPID CAPITAL MANAGEMENT INC | Mark Travis | 7.3% | 0.745 |

| BAKER BROS ADVISORS LLC | Julian & Felix Baker | 20% | 0.685 |

| WHALE ROCK CAPITAL MANAGEMENT | Alex Sacerdote | 7.3% | 0.666 |

| TRIAN FUND MANAGEMENT LP | Nelson Peltz | 3.1% | 0.625 |

| SPO ADVISORY CORP | John Scully | 3.7% | 0.591 |

Key Highlights - 4th Qtr 2016 vs. 3rd Qtr 2016

Many strong managers remained off the list. We required that managers have a positive start to the year on a StockAlpha basis, and many strong managers, including Viking Global, Third Point, among others were unable to stanch the losses that stemmed from the volatile market in 2016. Moreover, not only did their positions decline, they underperformed on a market, sector and beta adjusted basis, so the poor positioning in the year undermined their positive twelve and thirty-six month track records of top StockAlpha.

The specific circumstances of each manager are different, but prior reports and current analysis have indicated possible stress related to hedge fund crowding. As earlier reports have shown, crowded hedge fund positions tend to underperform dramatically in volatile markets such as we see today. The performance of the Symmetric Hedge Fund Concentration index and crowding scores provide a lens through which to see these effects. Though crowded positions have historically yieled consistent alpha, the Sharpe Ratio of those returns has declined, so the risk adjusted returns of crowded hedge fund trades have degraded substantially. For further analysis, please reference the crowding analyses and reports at Symmetric.io. It provides detailed analysis of individual managers according to the exposure to crowded positions, the effect on their portfolio overall, their relative positioning according to peers, and their overlap with other managers.

Symmetric Rankings - Recent Activity

What have the Skilled Investors been doing?

Skilled investors separate themselves from the hedge fund universe through their stock-picks. Unlike the picks of the universe overall, these picks are those that drive the top performers. We highlighted the positions skilled investors initiated, accumulated and exited recently.

Symmetric Top Managers - Top Five Recent New Positions

| Rank | Ticker | Name of Stock | Fund(s) | Crowding Score | QTD Stock-Return |

|---|---|---|---|---|---|

| 1 | EXPE | Expedia | Dorsal | 33% | 2.1% |

| 2 | PCLN | Priceline | Newbrook | 10% | 1.2% |

| 3 | APFH | AdvancePierre Food Holdings | Newbrook | 74% | 1.5% |

| 4 | DATA | Tableau | Dorsal | 26% | -7.8% |

| 5 | GIMO | Gigamon | Whale Rock | 3.4% | 4.7% |

Symmetric Ten's Top Five Recent Increased Positions

| Rank | Ticker | Name of Stock | Fund(s) | Crowding Score | QTD Stock-Return |

|---|---|---|---|---|---|

| 1 | PRGO | Perrigo | Starboard | 17.7% | -0.84% |

| 2 | AAPL | Apple Inc | Third Point | 3.4% | -6% |

| 3 | BABA | Alibaba Group | Third Point | 7.45% | -15% |

| 4 | HUM | Humana Inc | Third Point | 23.2% | 12.6% |

| 5 | CMG | Chipotle | Pershing Square | 8.6% | -2.2% |